The Economics of Pollution

Is it a legitimate goal to have zero pollution in society?

- Pollution, just like most things in economics, is a "how much" question that requires benefit/cost analysis

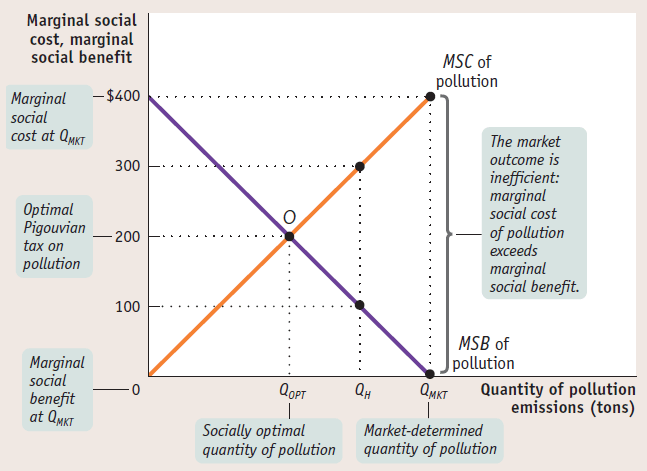

Marginal social cost of pollution

additional cost imposed on society created by a unit of pollution

ie. acid rain harms crops and forests

Marginal social benefit of pollution

additional benefit to society from a unit of pollution

ie. pollution avoidance incurs an opportunity cost and is expensive

Socially optimal quantity of pollution

point at which marginal social cost (MSC) equals the marginal social benefit (MSB)

MSB = MSC

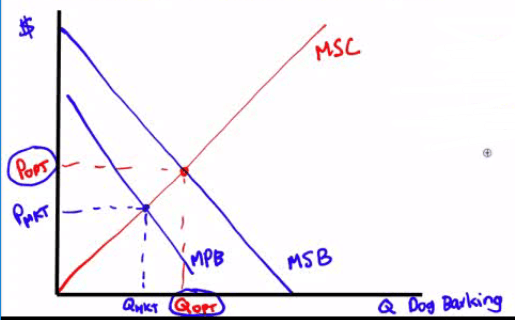

Socially Optimal Quantity of Pollution

Upward-sloping MSC curve

Downward-sloping MSB curve

Intersection of MSC and MSB is socially optimal point

Market-determined quantity of pollution is where MSB is x-axis

Not allocatively efficient: Q too high, Price too low

In the absence of government intervention, the quantity of pollution will be QMKT, the level at which the marginal social benefit of pollution is zero.

This is an inefficiently high quantity of pollution: the marginal social cost, $400, greatly exceeds the marginal social benefit $0.

An optimal Pigouvian tax of $200, the value of the marginal social cost of pollution when it equals the marginal social benefit of pollution, can move the market to the socially optimal quantity of pollution, QOPT

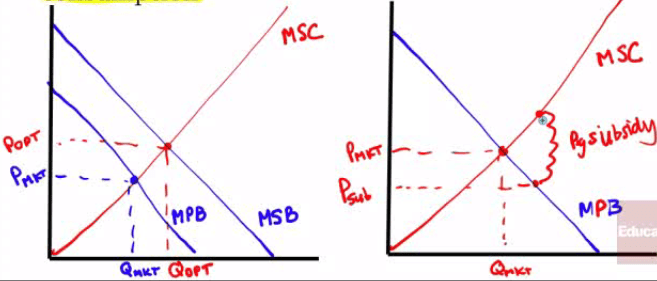

Negative Externality vs. Positive Externality

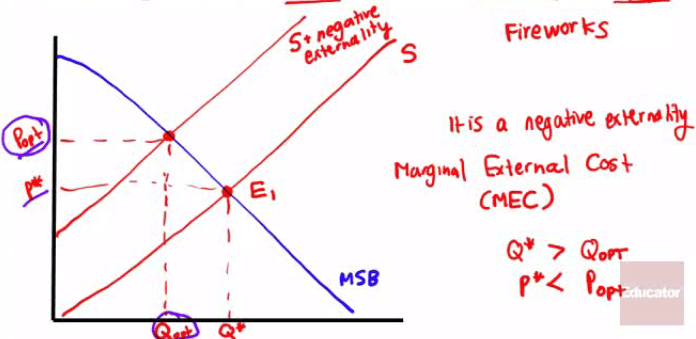

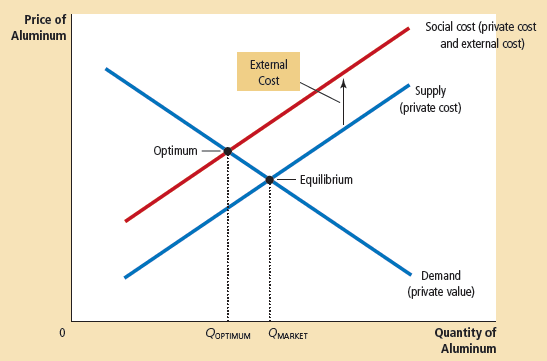

Negative externality

a decision that a firm or individual makes that imposes a cost to "society" as a whole (ie. the decision to pollute)

Impact is similar to that of a supply shift to the left on a supply and demand graph

Market price too low, Market Quantity too high

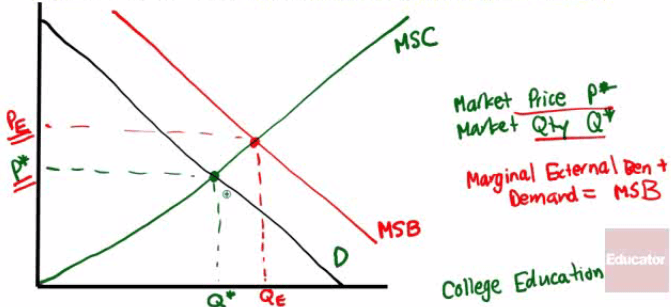

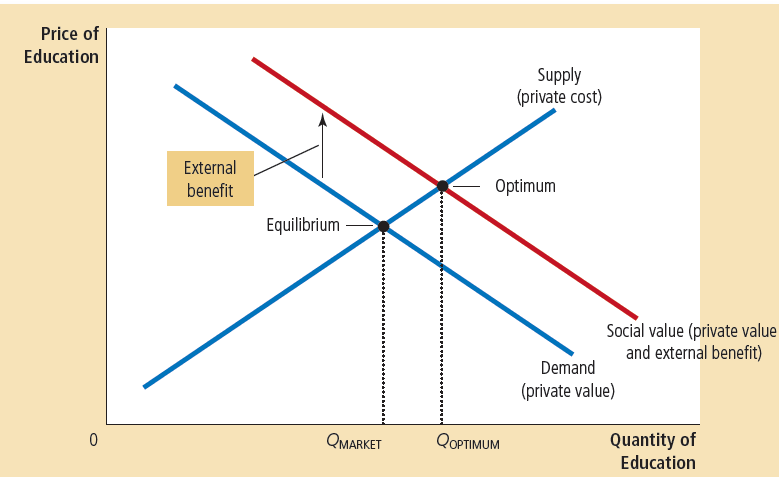

Positive externality

a decision that an individual or firm makes that yields positive benefits to society (ie. the decision to attend college and become a productive citizen)

Impact is similar to that of a demand shift to the right on a supply and demand graph

Market price too low, market quantity too low

Government Solution

By what means would the government be able to correct a nagative externality?

- Tax

By what means would the government be able to encourage a positive externality?

- Subsidy

Private (or Coase) Solution

Coase Theorem

- Even in the presence of externalities, an economy can be efficient (assuming low transaction costs) by internalizing the externalities

Example

Let's say that Jeff and Chris are neighbors in Chino Hills and that Jeff enjoys throwing loud parties wile Chris does not

Chris does not enjoy the music but Jeff has a legal right to play loud music, so Chris can play Jeff a payment equal to the external cost he imposes on him

Or, if Jeff does not have a legal right to play loud music, Jeff can pay Chris an amount equal to the cost the music imposes on Chris

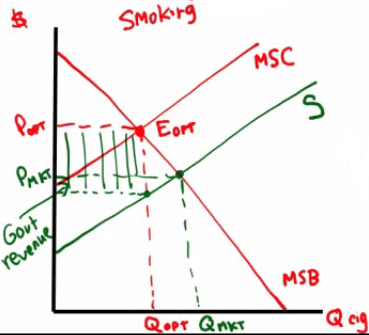

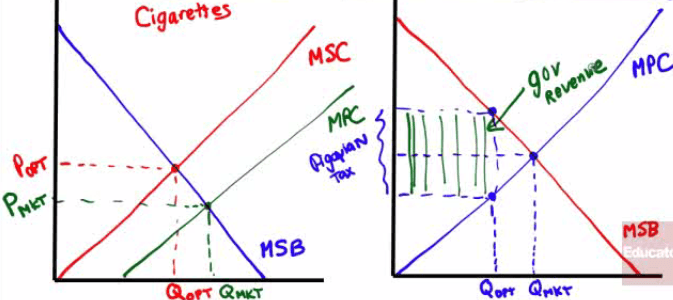

Pigouvian taxes

- named after economist A.C. Pigou, these taxes were designed to reduce external costs

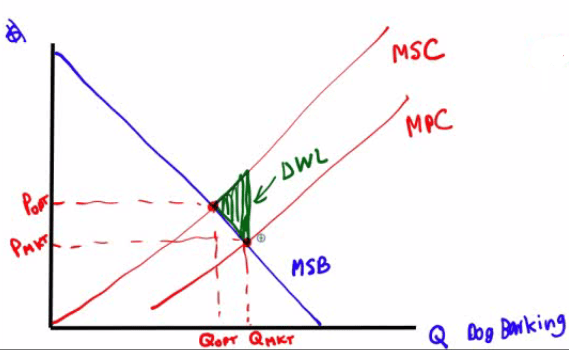

Negative Externality Example

Formula

MSC = MPC + MEC

MSC: Marginal Social Cost

MPC: Marginal Private Cost

MEC: Marginal External Cost

Smoking cigarettes is considered a negative externality

An optimal Pigouvian tax charges where MSC = D, so that less quantity is consumed at a higher price

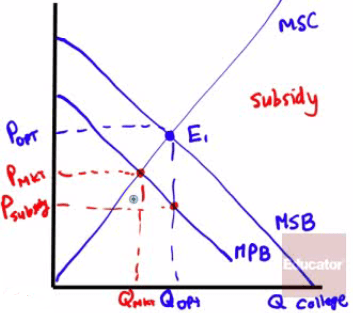

Positive Externality Example

Formula

MSB = MPB + MEB

MSB: Marginal Social Benefit

MPB: Marginal Private Benefit

MEB: Marginal External Benefit

Getting a flu shot not only benefits you but also reduces the number the number of others getting the flu by as much as 1.5

Getting a flu shot is considered a positive externality

An optimal Pigouvian subsidy intersects where MSB = S. Lower prices encourages consumption

Practice Question

Draw a correctly labeled graph of the market for dog barking contests that is perfectly competitive. If neighbors are disturbed by dog barking, draw the marginal social cost curve, labeled MSC. Label the marginal social benefit curve, labeled MSB, and shade in the deadweight loss or DWL, if any.

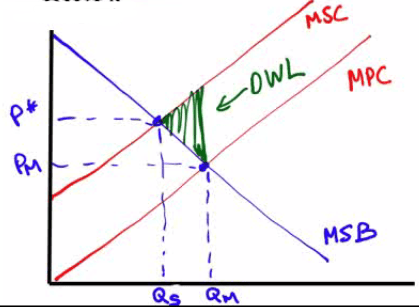

Draw a correctly labeled graph of the market for dog barking contests that is perfectly competitive. If neighbors now enjoy dog barking, is the market equilibrium greater, less than or equal to the socially optimal quantity? If the government bans dog barking, will the deadweight loss increase, decrease, or remain unchanged?

Market equilibrium is less than optimal

Deadweight loss will increase

Assume that the market for paper bags is perfectly competitive and that they create a negative externality. Draw a graph that includes the MPC and MSC, as well as the market quantity, Qm. Label the allocatively efficient quantity as Qs and shade the area of deadweight loss and label as DWL. If a lump-sum tax is imposed, what happens to DWL?

- Allocatively efficient: MSC = MSB

The DWL stays the same